7 Ways AI Content Generation Is Changing the Game for Singapore Startups

November 20, 2025

Asian Market Penetration: Effective B2B Lead Generation Tips

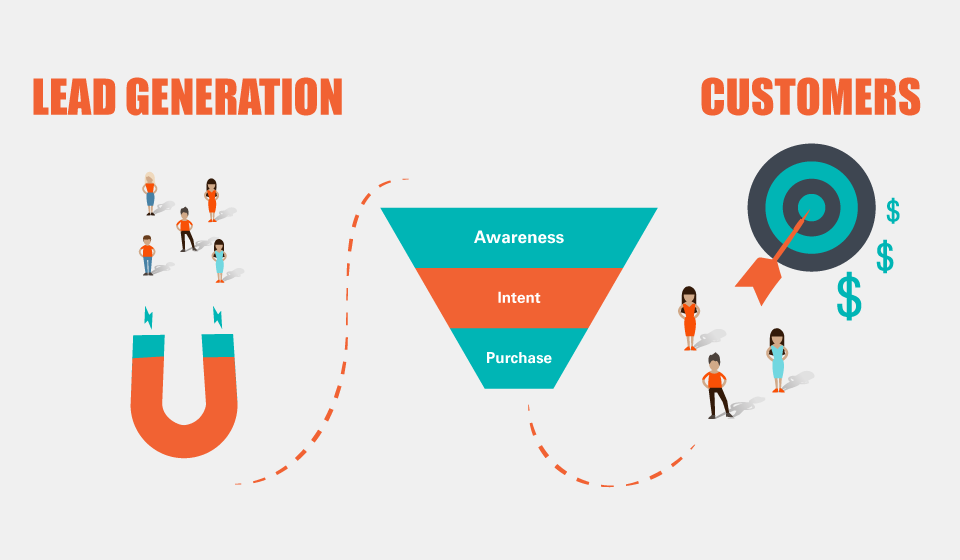

November 21, 2025Asia isn’t a single market—it’s a tapestry of cultures, communication norms, buyer expectations, and growth rhythms. Anyone trying to approach B2B Lead Generation for Asia without acknowledging this complexity is setting themselves up for frustration. A high-converting pipeline requires more than targeting; it demands regional fluency.

The region’s buying journey tends to be shaped by trust, reputation, and patience. In Japan, teams prioritize formality, detail, and long-term reliability. Korea values proven outcomes and credible expertise. Southeast Asia moves fast but relies on relationships and social validation. China operates within its own digital frameworks, where platform reputation and ecosystems heavily influence decisions.

None of this can be navigated with generic messaging. Companies that win in B2B Lead Generation for Asia understand that “local relevance” isn’t optional. A Singaporean CTO, a Malaysian procurement director, and a Vietnamese operations leader all respond to entirely different triggers.

This landscape rewards respect and preparation. When your team internalizes these regional nuances, your pipeline stops being a guessing game and starts becoming a predictable, insight-driven system. The tough truth? If you treat Asia as a monolith, your results will always fall short. Understand the humans. Understand the rhythm. The conversions follow.

This foundational understanding becomes the structural core of any sophisticated B2B Lead Generation for Asia framework.

Crafting a Strong Cross-Asia B2B Value Proposition

Your value proposition is the moment prospects decide whether to keep listening. In Asia, that moment carries even more weight. For B2B Lead Generation for Asia to be effective, your message must be locally grounded, culturally aware, and sharply aligned with regional needs.

Asia’s business leaders don’t respond to broad claims. They respond to clarity supported by evidence. Different markets require different angles. Southeast Asia gravitates toward agility and scalability. Japan values precision, reliability, and minimal risk. India respects innovation and efficiency. Hong Kong appreciates speed and ROI.

A winning value proposition speaks to their actual problems—not your product features. Instead of pitching what you offer, articulate what you understand. A prospect feels seen when you reflect their world back to them. That’s how trust starts, and trust is the decisive currency across this region.

Authority also matters. Local testimonials, regional case studies, and geographically relevant social proof carry strong influence. Asian buyers look for signals that you’ve succeeded in their neighborhood, not just in your home market.

The brands that succeed in B2B Lead Generation for Asia refine their positioning continuously. They adapt without losing identity. They communicate strength without arrogance. And they build familiarity before selling anything.

Get your value proposition right, and the doors open more easily everywhere in Asia.

Creating Data-Driven Ideal Customer Profiles

Precision is survival in B2B Lead Generation for Asia. A data-driven Ideal Customer Profile isn’t a document; it’s a strategic compass. It helps you focus on the right companies, understand their decision patterns, and eliminate noise that drains your sales energy.

Start by mapping regional industry trends. Some markets lean into fintech maturity. Some prioritize automation. Others accelerate in cloud adoption, logistics innovation, or digital commerce. Your most natural fit lies where regional momentum meets your product strengths.

Firmographics alone aren’t enough. You need behavioral cues, cultural buying tendencies, and regional procurement insights. For example, certain markets involve broader committees before approving purchases. Others value long-term vendor relationships over disruptive change. In some places, reputation is everything. In others, technical advantage wins the day.

These details must shape your ICP—not assumptions or one-size-fits-all templates. A single “Asia ICP” is unrealistic. Instead, create multiple ICPs that reflect local realities. This is how you fuel sharper targeting and deeper resonance in your outreach.

Strong revenue teams treat ICPs as evolving entities. They refine them continuously based on closed-won patterns, lost deals, and shifting market signals. They lean heavily into data from previous cycles and let insights—not hopes—dictate prioritization.

With the right ICPs in place, B2B Lead Generation for Asia becomes dramatically more efficient. Every message hits harder. Every conversation feels more relevant. Every conversion becomes more predictable.

Executing a High-Performance Asia-Focused Lead Generation Strategy

Asia’s digital environment is dynamic, fragmented, and highly platform-specific. Winning at B2B Lead Generation for Asia means showing up where buyers actually spend their time—not where you hope they are.

LinkedIn dominates in some countries. In others, localized business platforms or closed community networks carry more influence. Some markets thrive on email outreach, while others respond more strongly to messaging tools, webinars, or partner-driven introductions.

The region demands a multi-channel approach. Relying on a single tactic is a guaranteed way to blend into the noise. The most successful teams balance direct outreach with content, industry events, digital advertising, and strategic collaborations.

Lead magnets also need to be localized. Some markets favor comprehensive, technical documentation. Others engage more with interactive workshops or market trend briefings. A lead magnet that converts well in one country may flop in another.

What separates high-performing brands is their relentless iteration. They experiment with messaging weekly. They adapt their tone for cultural expectations. They personalize without overcomplicating. And they monitor signals closely to ensure every move aligns with what the market responds to.

A strong Asia-focused strategy isn’t about shouting louder—it’s about speaking smarter. When you understand the platforms, the rhythms, and the expectations, your B2B Lead Generation for Asia starts building momentum instead of resistance.

Implementing Efficient Lead Qualification and Follow-Up Systems

Asia rewards brands that qualify leads accurately and follow up with consistency and respect. No matter how strong your outreach is, your pipeline will bleed if your qualification system isn’t built for regional realities. This is where many B2B Lead Generation for Asia programs fail quietly.

Lead scoring needs to reflect cultural nuances. Engagement signals differ widely from market to market. Some buyers show interest through detailed content downloads, while others engage through more conversational channels. Some markets respond to quick follow-ups. Others appreciate patience and space.

Understanding these signals helps your revenue team avoid misreading intent. It also helps you focus on the right accounts at the right time.

Follow-up systems need just as much thought. Asian buyers value steady, respectful persistence. They rarely appreciate aggressive chasing, but they do expect vendors to stay present and available. That balance—firm yet considerate—is what keeps your conversations alive.

Automation plays a role, but automation alone is not enough. A nurturing sequence must feel human, contextual, and regionally relevant. SDR teams benefit immensely from training in cross-cultural communication, especially in tone, formality, and timing.

The ultimate goal is clarity. Your team should know who is worth pursuing and why. When qualification is tight and follow-up systems are tuned to local expectations, your pipeline becomes far more durable and your B2B Lead Generation for Asia outcomes improve dramatically.

Nurturing Leads to Achieve Higher Conversion Rates

Lead nurturing is where long-term wins are forged in B2B Lead Generation for Asia. The region’s buyers often require more time, more context, and more reassurance before committing. Nurturing is not an afterthought—it’s the backbone of conversion.

Localized nurturing is essential. Emails must reflect regional concerns, local market insights, and relevant case studies. Automated touchpoints help maintain consistency, but they must feel natural and helpful—not mechanical or generic.

Educational content is one of the most effective nurturing tools in Asia. Webinars, demos, and workshops create trust and proximity. Buyers want to learn from experts. They want to see your competence in action. They want to know that you understand their local business terrain.

Patience is key. In some markets, silence doesn’t mean disinterest—internal discussions simply operate at a different tempo. Thoughtful, spaced nurturing ensures you stay top-of-mind without overwhelming the prospect.

Long-term nurturing strategies create momentum through regular value delivery: localized insights, industry trend reports, regional benchmarks, and peer stories. This isn’t about frequency—it’s about substance.

When nurturing is done well, cold leads warm up naturally, and warm leads turn into committed conversations. It’s one of the greatest multipliers in B2B Lead Generation for Asia because it builds the trust required for decisions.

Conclusion: Building a Pipeline That Thrives Across Asia

A strong cross-Asia B2B pipeline isn’t built with shortcuts. It’s built with intention, cultural intelligence, and a deep respect for the region’s diversity. Asia rewards teams who listen more than they talk and adapt more than they assume.

When you understand regional nuances, sharpen your value proposition, define data-driven ICPs, deploy localized strategies, qualify intelligently, and nurture consistently—you build a pipeline that can withstand market shifts and grow sustainably.

Ultimately, the heart of successful B2B Lead Generation for Asia isn’t in tactics alone. It’s in trust. Build that trust deliberately and authentically, and Asia will open doors you never knew existed.